Business Use of Your Car: Mileage and More

You know you can deduct costs related to using your personal vehicle for business and of course you want to take as much of a tax deduction as you can. What are the rules and how much can you take? Find out here.

This post has two sections. The first part explains the general rules for business related mileage and car expenses. The second part gives examples to demonstrate what kinds of car trips you can deduct. It is always advisable to consult with a professional, however, it's also helpful to know the rules that apply to your business because ultimately it is you, the business owner, who is responsible for following the tax rules.

The IRS explains business transportation deductions in several places on their website, though the primary source for transportation and travel deductions is IRS Publication 463. Consult the IRS links in this post to learn more.

- IRS Publication 334: Tax Guide for Small Businesses

- IRS Publication 463: Travel, Car, and Gift Expenses

- Standard Mileage Rates

Note these deductions are for self-employed, business owners and independent contractors. If you are a W2 employee, the new tax law took away deductions for unreimbursed expenses. Business owners can choose, if they wish, to reimburse employees for such costs.

Consult a professional tax preparer if any of the following apply to you: if you want to deduct actual car expenses rather than standard mileage, you use multiple cars at the same time for business, you drive an employer provided vehicle, you drive a large specialized truck or van or transport people with your vehicle or you are an independent contractor who is reimbursed for expenses by someone else. Even if these situations do not apply, it is always a good idea to consult a professional.

General Rules

This section covers the general rules for business related car expenses. In the next session there are examples of specific transportation related deductible expenses.

Personal vs. business expenses

Personal use of your car is not deductible as a business expense. Personal use includes your normal commute to work from your home, parking at your regular office and any miles driven for personal reasons. Business use includes driving for business errands, driving to a business event, driving between two offices, driving for an out of town trip or two the airport to fly out of town. If you have a qualified tax home office, trips from your home may be deductible. See the record keeping and home office sections below.

Deductible car expenses

You are able to deduct the cost of operating your car for a business purpose. You can either use the standard mileage rate or actual car expenses. Regardless of which method you choose, you must track your miles driven for business and only deduct mileage/costs for business related driving.

Standard mileage rate

The simplest way to deduct car expenses is use the standard mileage rate for business miles you drive. Each year the IRS announces a new rate. Individual states usually mirror the IRS rate. Current and recent standard milage rates for business driving are below.

Note: the IRS can and has in the past increased the standard mileage rate mid-year if there are rising gas prices.

2025: $0.70 per mile

2024: $0.67 per mile

2023: $0.655 per mile

If using the standard mileage, no other car expenses such as gas or repairs are allowed, it is one or the other. The deduction is simply number of miles driven for business times the mileage rate.

Even if you take the standard mileage deduction, you may be able to also deduct interest on a car loan. If you are self employed and file on schedule C, you can deduct a percentage of car loan interest based on how much you use your car for business. For example, if you use your car 30% for business you can take 30% of the interest as a deduction on Schedule C.

Actual Car Expenses

As an alternative, you can deduct the portion of actual car expenses you incur instead of, not in addition to, the standard mileage rate. You still only get to deduct the portion that relates to business miles so you must keep a mileage log. Plus you have to save every receipt for car expenses. It is more work and could result in a smaller deduction. Car expenses include: depreciation, licenses, gas, oil, tolls, lease payments, insurance, garage rent, parking fees, registration, repairs and tires. If you drive your car 20% for business, you will only be able to deduct 20% of the actual car costs.

If you think you may want to choose the actual car expenses method be sure to see a professional tax preparer before you make this choice.

Switching methods: own or lease

If you own your car and you want to use the standard mileage rate, you must choose the standard mileage rate in the first year you use the car for business. After that you can switch. If you choose actual expenses in the first year, you must continue to use actual expenses as long as you use that car for business.

If you lease your car, you can take the standard mileage deduction or actual expenses. However, if you choose the standard mileage it has to be for the entire term of the lease. If you choose actual car expenses for a leased vehicle, consult a tax preparer as special rules apply to the calculation.

Commuting expenses not deductible

Costs of driving your car or taking an uber, train, trolley or other form of transportation to get from home to your main place of work from your home are usually not deductible. These are considered commuting expenses. There is an exception if you have a home office.

Parking fees and tolls

You may also deduct some parking fees and tolls. However, parking fees at your main place of work and tolls to drive there are not deductible. If you go somewhere other than your main place of work for a business purpose, the parking and tolls are deductible. This includes parking at a client location, bank, training or conference, networking event, business meeting or when running business errands.

Tax deductible home office

If you have a home office that meets all the rules and requirements detailed in IRS Publication 587: Business Use of Your Home, and you take the deduction on your taxes, then your home is considered a business location. It might be your main place of work or a second work location. This enables you to deduct car trips from home to a physical office if you are working in both that day. If you work from home but do not have a tax deductible home office, your trips to and from home are not deductible. See the home office blog for more information.

Tax home: travel vs. transportation

The IRS distinguishes two types of car expenses: a) travel away from home and b) transportation within your tax home.

Your tax home is wherever you have your main place of work. You may work in more than one city or town, making it unclear which one is your tax home. If you work in more than one location, to determine your main place of work consider where you spend the most time, where you do the most work and the amount of income that originates from each location. It is possible to have no main place of work and your tax home may be where you live or where you are currently working.

Your business tax home "includes the entire city or general area in which your business or work is located." (IRS Pub 463). If your office is in San Francisco, CA, then any business related driving in San Francisco is in-town transportation. If you drive to Sacramento, CA for a conference, that is considered travel away from home.

Traveling away from your tax home

When traveling away from your tax home you can deduct ordinary and necessary expenses. This includes mileage and tolls if you drive out of town or if you fly, mileage to the airport and car rental expenses or taxi/uber expenses in the out of town location. For other travel related deductions, see Business Related Travel: What is Deductible.

Mileage driving to another city or state

If you drive to a training or convention out of town you can deduct the mileage to get to and from the business location and parking while. If you are there several days you may also do personal driving when not attending the event. Personal driving and parking, for example if you are sight seeing, is not deductible.

Mileage to the airport

If you are traveling for business and you drive to the airport, you can deduct the trip from your home to the airport and back. You can also deduct the cost of parking at the airport and any tolls.

Car rentals

If you rent a car while away on business you can deduct only the business related portion of the car rental. (IRS Pub 463 Table 1-1, car expenses). You cannot deduct the car rental for any portion of the trip that is personal.

Temporary work location

If you have a main place of work but you are going to spend time working in another location for a year or less, that location becomes a temporary work location. The IRS allows you to deduct the daily round trip transportation to the temporary work location. (IRS Pub 463).

Two business locations

You may also have two business locations. You can deduct the mileage incurred driving directly between the two locations on the same day. If you only go to one location each day, each trip is your normal commute and your normal commute is not deductible. If you have a tax deductible home office, you can deduct driving from the home office (one business location) and a physical office (second business location).

Recordkeeping

The IRS does not specify exactly what documentation you must keep to be able to deduct car expenses, though they do have an example log. (IRS Pub 463). Documentation is expected to be kept timely, at or near the time the expense is incurred. You may not have time to complete the log on the day you drive, but you want to create it soon, not several months later. You can also use an app to track driving such as MileIQ, Everlance, or Quickbooks but also make sure to keep your odometer reading from start and end of the year, if not each month, if the app is not keeping a record of it.

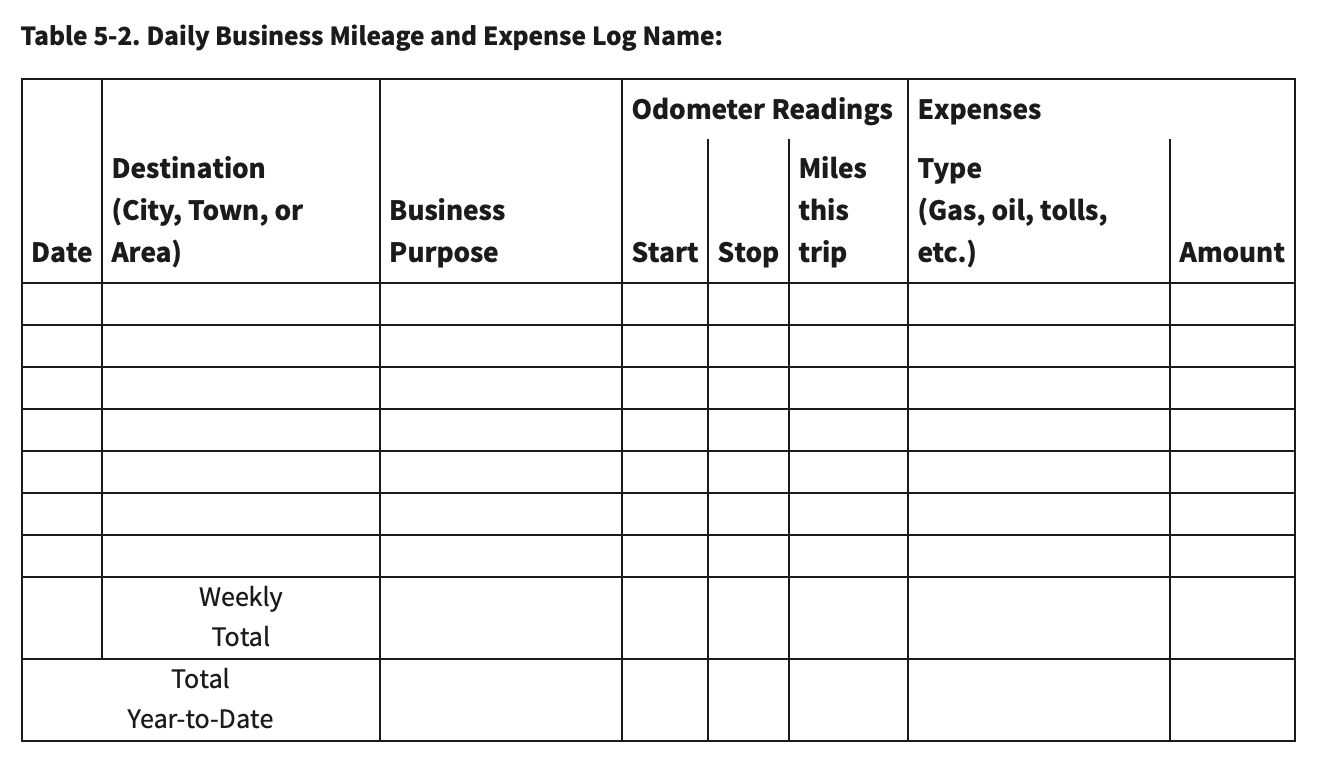

Screen shot from IRS link:

Best practice

The best documentation will be a log (see Table 5-2 on this link for an example) that includes 1) date of the trip, 2) start and destination addresses, 3) business purpose, 4) starting and ending odometer reading and total miles driven, 3) type of expense (mileage, parking, etc) and 5) the amount you will be deducting. For parking or actual car expenses, you also need receipts.

The IRS is particularly concerned with documentation to support your January 1 and December 31 odometer reading. This will help establish the percentage of miles you are claiming as business related. If you can establish these readings with car repair receipts from an oil change or service, that is ideal. Otherwise take a photo that you can prove was taken on or near the beginning and end of the calendar year. This could be another phone or watch with a date and year in the photo or perhaps uploading a photo of the odometer reading to a mileage app or posting it somewhere that has a date stamp.

If your documentation includes protected health information (PHI) such as a client address, you do not have to include PHI in your car log book, but the information is expected to be kept somewhere you can access it if needed.

Alternative to best practice & incomplete records

If you do not have the odometer reading for each trip you at a minimum need your car odometer reading at the start and end of the tax year. Basic documentation would also include date, location, number of miles driven for each trip and the business purpose of the trip. Any time your documentation falls short, you can create a written statement and use other available evidence to show that you incurred a legitimate business expense (see IRS Pub 463 "What if I have incomplete records.")

Mileage tracking apps

When choosing to track business mileage with an app, determine what information will be captured and decide if it is sufficient enough for you. If the app does not track odometer readings, ensure you have a record of your odometer reading on January 1 and December 31. There is no information to say the IRS will reject a mileage tracking app as support for business mileage deductions but you may want to track additional information just in case. If you do use a mileage app that charges a fee, that fee would qualify as a business deduction as long as you are using it exclusively for business mileage tracking.

Sampling

You can also use sampling. Sampling is occasionally tracking all the details of your car expenses. The IRS uses the example of a taxpayer who tracks their mileage the first week of each month showing they use their car 75% for business. Other records show this is a consistent and reliable percentage. The IRS will then allow you to deduct 75% of your miles driven as long as you have a start and end odometer reading. This method is only viable if you use your car for business consistently week to week. If your car travel varies week to week, do not use sampling.

Destroyed records

If your records are destroyed due to an event outside of your control such as a fire or flood, you can reconstruct them to the best of your ability.

Accountable plans

If you are taxed as an S-Corp, or you reimburse employees, you need to have an accountable plan. This creates a process to provide documentation of expenses to your business timely in order to be reimbursed for business related expenses. It is best for all S-Corps or businesses who have employees to work with a professional tax preparer to ensure they are following the accountable plan rules. Not following accountable plan rules can result in reimbursements being taxed as wages.

Sole proprietors and LLC's owners who do not have employees and are not taxes as S-Corps will keep the same detailed records but will not need an accountable plan.

Other circumstances

There are special rules for the following scenarios may require doing additional consultation with a professional:

- More than one main place of work

- No main place of business or work

- Deducting actual expenses for a vehicle you own or lease.

- You are a reservist

Deduction examples

The IRS has an illustration of transportation expenses that is useful. (IRS Pub 463). Generally your mileage will be deductible if you are driving for business purpose and it is neither a non-deductible commute nor for personal reasons. This section will cover a variety of car trips and what is and is not deductible. It will not cover every possibility. When in doubt, consult your tax preparer.

Attending a training or conference

You spend a week going to a training that you drive to. Whether or not it is located in the same city as your main place of work, you can deduct the round trip commute from your home to the training or conference if the entire trip is for a business purpose.

Going to a meeting or networking event

If you drive to a meeting or networking event, it is similar to driving to training. Whether your trip starts from your home or from your place of business, you can deduct the round trip mileage to and from the business meeting or business related event.

Running business errands

If you run business errands the mileage driven is deductible. Say you are at your office and you drive to the bank to make a deposit and then to the office supply store and back to your office. The entire trip can be deducted because it is entirely for a business purpose.

Two business activities in one day

If you work at two places in one day you can deduct the mileage between the two work places. For example, if you work at a physical office then you teach a class in the evening for which you are paid, you can deduct the trip from your office to the school.

Business and personal driving combined

If a portion of your trip includes personal driving, that portion of the trip is not deductible. Say you are at your office and you drive to the bank to make a deposit. Then you drive home. Your trip between your office and the bank is deductible, but the trip home is a normal commute and not deductible.

Another example, you are at your office, you drive to your child's school for an appointment and then to a networking event and back to your office. Do not deduct the trip your child's school, that is personal.

If you are driving for an out of town conference that last a week and while there you do personal sightseeing, only the business miles count toward your tax deduction. You would not count miles or expenses for the personal activities. Your drive to and from the conference and parking while there is still deductible.

Home office with personal driving

Not all trips from home will be deductible. A good question to ask yourself, "Is this trip from my home for a business purpose or for a personal reason?" For example, going from your home office to your physical office to get a forgotten sweater is personal and not deductible. Likewise, going to your physical office on a day you do no work at all in your home office would make it your normal commute to work and not deductible.

Car loan interest

The tax law passed in 2025 added a new car loan interest deduction which is a personal deduction only. This cannot be taken for a car used for business. The interest is limited and the deduction is phased out for higher income earners. The deduction only applies to new cars purchased with a car loan between 2025 and 2028 and the car must be made in or final assembly in the US.

Bottom line

As a business owner it is important you know and follow the IRS rules for business use of your car. When in doubt, focus on three things: whether your drive has a business purpose, the proper amount to deduct and keeping detailed records. Always consult a professional if needed.

Updated 10/1/2025

The Simple Profit membership provides support to business owners. Get the education and resources you need to make informed business decisions and establish quality business processes, including bookkeeping and cash management tasks.